Odyssey Reinsurance Company brings its expertise, high-quality service and capital to the table every day to deliver innovative reinsurance solutions to our clients and business partners around the world. We value our long-term relationships, seek to form new relationships and pride ourselves on exceeding service expectations.

Our reinsurance business operates through a global network of 13 branch, representative and service offices across five regions: North America, Latin America, Europe, Middle East & Africa (EMEA), AsiaPacific and London. Each region is comprised of talented, dedicated teams of underwriters, actuaries, claims professionals and catastrophe modelers.

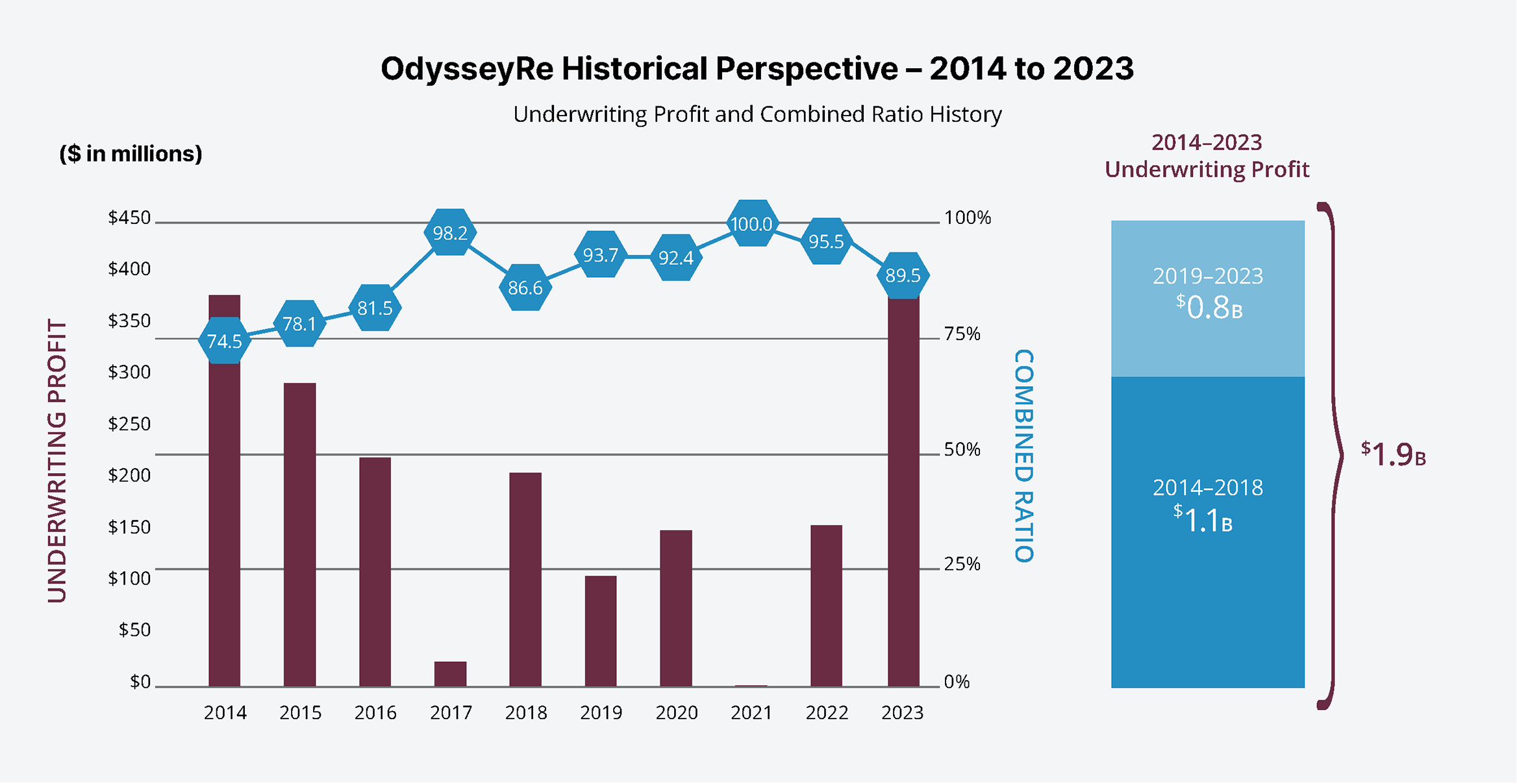

In 2023, we produced $3.7 billion of gross premiums written, an increase of 0.5% over the prior year. While growth was relatively flat, our five-year average growth rate is 15%, reflecting improving market conditions in reinsurance in recent years. Our reinsurance portfolio generated a combined ratio of 89.5% in 2023, compared to 95.5% in 2022, which is a testament to our defined risk appetite, diversification and underwriting discipline.

We continue to be excited about the reinsurance market and are open to expanding our portfolios where pricing is adequate. The stability of our workforce, our focus on customer service and our capital strength means that we are well positioned to meet our clients’ reinsurance needs for many years to come.

$3.7B

2023 Gross Premiums Written

89.5%

2023 Combined Ratio

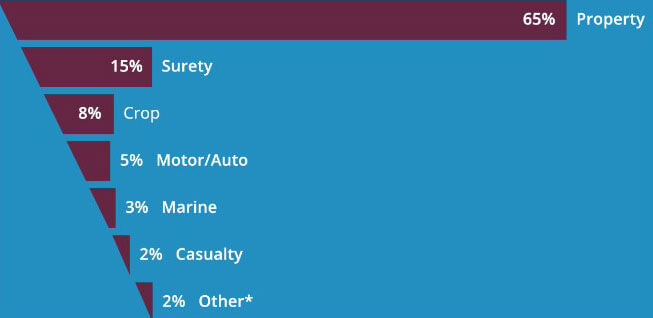

*Other includes Aerospace, Energy and Multiline

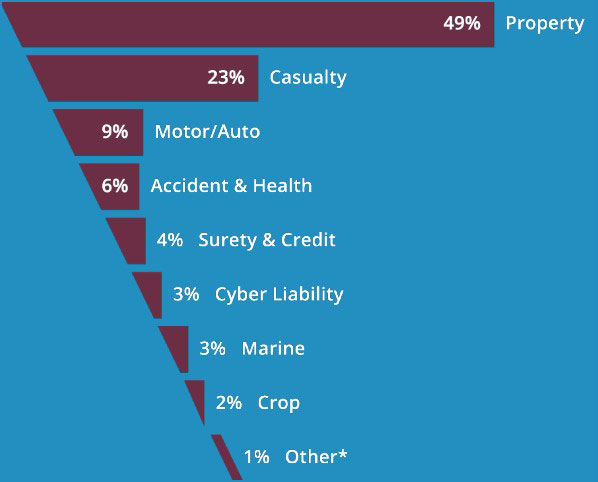

Treaty:

Facultative:

OdysseyRe’s North America team offers treaty and facultative reinsurance to clients in the U.S. and Canada. Treaty facilities are based in Stamford, with additional offices in Toronto and Montreal. Casualty facultative underwriters operate from New York.

Brian D. Quinn

Chief Executive Officer

Treaty:

Facultative:

$2.4B

2023 Gross Premiums Written

*Other includes Crop, Marine and Aerospace

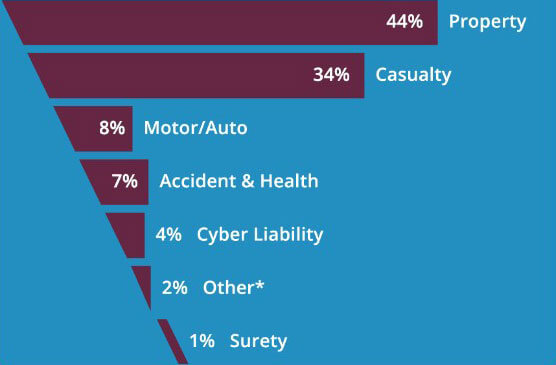

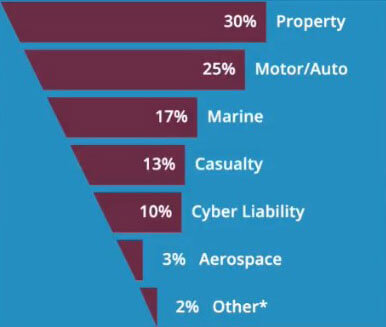

OdysseyRe offers treaty reinsurance in Europe, the Middle East and Africa (EMEA) from its offices in Paris and Stockholm. The Paris-based underwriting team is responsible for underwriting all property and casualty treaties in EMEA, while the Stockholm office services the Nordic and Baltic markets.

Isabelle Dubots-Lafitte

Chief Executive Officer, Europe, Middle East and Africa

$614M

2023 Gross Premiums Written

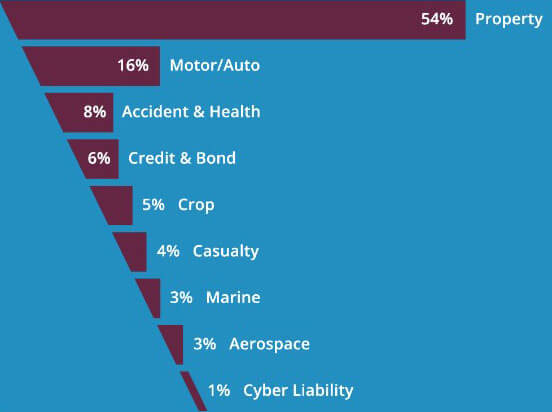

OdysseyRe’s AsiaPacific team underwrites treaty reinsurance from Singapore, with the support of two representative offices in Beijing and Tokyo. Its geographical focus includes China, Japan, South Korea, Hong Kong, India, Southeast Asia, Australia and New Zealand.

Lucien Pietropoli

Chief Executive Officer

$303M

2023 Gross Premiums Written

Treaty:

Facultative:

OdysseyRe provides treaty and facultative reinsurance to clients located in all countries throughout Latin America and the Caribbean. Underwriters are based in Mexico City and Miami.

Philippe E. Mallier

Chief Executive Officer

Treaty:

Facultative:

$292M

2023 Gross Premiums Written

*Other includes Accident & Health, Multiline and Aerospace

OdysseyRe’s London branch provides treaty solutions to reinsurance clients, principally operating from the U.K., including Lloyd’s. For certain classes of business, such as marine, energy, aerospace and retro, the branch has a global remit given the London market’s leadership positions in these sectors.

Robert Pollock

Chief Executive Officer

$179M

2023 Gross Premiums Written

*Other includes Credit & Bond, Accident & Health, Energy, Multiline and Affinity