Our insurance portfolio has experienced tremendous growth during the past decade, and our five-year average growth is 13%. Growth is slowing, but the market remains very attractive across most product lines. In 2023, gross premiums written generated by our insurance operations were $2.8 billion, a decrease of 8% over the prior year, primarily due to softened market conditions.

It was the 10th consecutive year that our insurance operations generated an underwriting profit, with a net combined ratio of 97.1%, an increase of 4.2 points from the prior year.

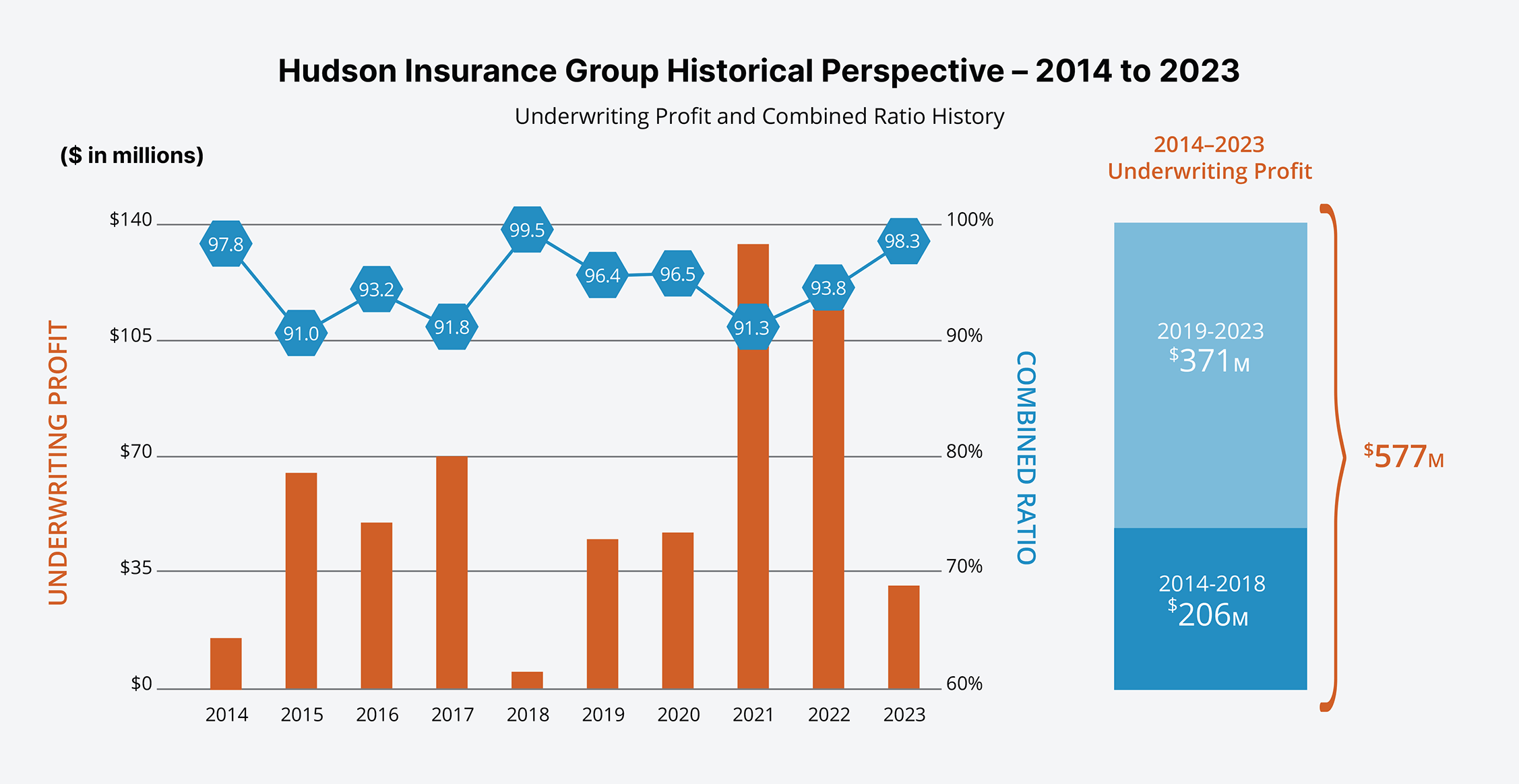

In the U.S., insurance is underwritten by Hudson Insurance Group. With headquarters in New York and offices across the U.S. and in Vancouver, Canada, Hudson offers primary and excess insurance on an admitted and non-admitted basis.

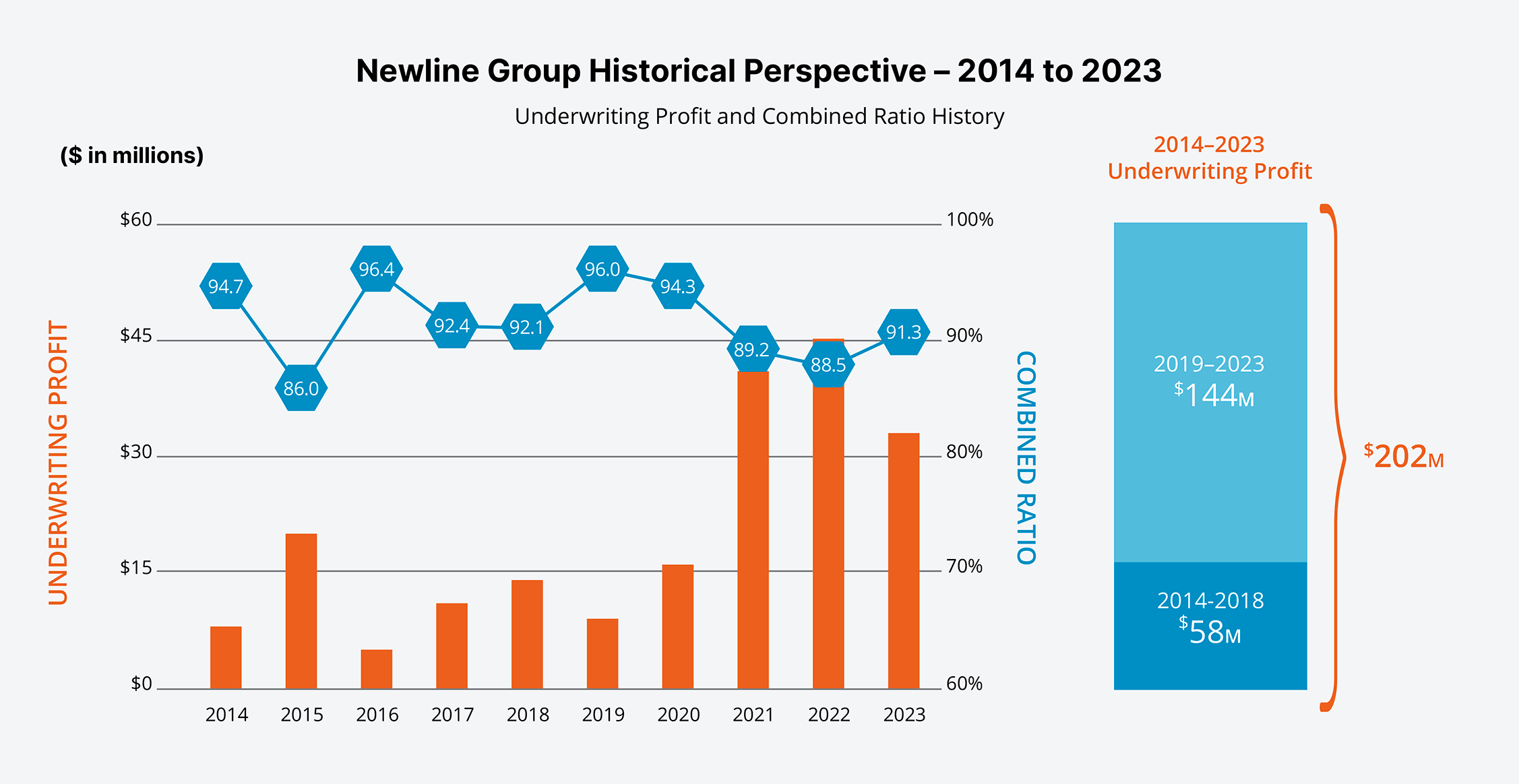

Outside the U.S., Newline Group offers insurance products in more than 80 countries around the world. It is headquartered in London and operates through three underwriting platforms: Newline Syndicate 1218 at Lloyd’s, Newline Insurance Company Limited and Newline Europe Versicherung AG (Newline Europe).

Christopher L. Gallagher

Chief Executive Officer

Hudson Insurance Group

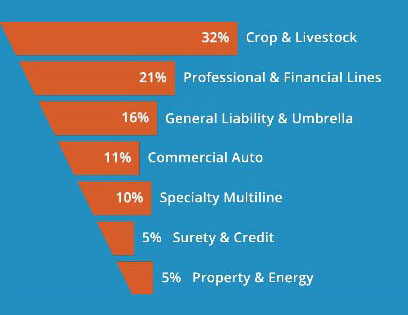

Hudson Insurance Group is widely known for serving market niches that require highly specialized claims and underwriting capabilities. Over the past 10 years, Hudson has experienced significant, consistent growth and today is a full-featured, robust insurance platform that offers an array of property, casualty and specialty insurance products to corporations, professional firms and individuals through retailers, wholesalers and program administrators.

Hudson reported gross premiums written of $2.4 billion in 2023 compared to $2.6 billion in 2022. The decrease of 8% is primarily due to the repositioning of its Crop portfolio to focus on more profitable commodities regions, and softened market conditions in other lines, particularly Management Liability. Aside from these exceptions, the overall insurance market remains attractive.

2023 was the 10th consecutive year that Hudson reported an underwriting profit, ending the year with a net combined ratio of 98.3% compared to 93.8% in 2022. Key contributors include HudsonPro®, coverage for Sovereign Nations and specialty Property & Energy insurance. The result was also driven by a relentless dedication to underwriting diligence.

Hudson has continued to invest heavily in talent across the organization. In 2023, HudsonPro expanded its suite of products to include a new Digital Health offering, the General Liability team launched a Cannabis Wholesale Casualty product, and Hudson grew in the market for large account environmental risks. Hudson also opened a new office in Richmond, Virginia to support its growing General Liability practice.

Uniquely positioned as a strong company with long-term consistency of management, strategy and underwriting discipline, Hudson is committed to providing specialized insurance solutions, responsive service and excellent claims handling for many years to come.

$2.4B

2023 Gross Premiums Written

98.3%

2023 Combined Ratio

Robert S. Pollock

Chief Executive Officer

Newline Group

Newline provides an array of bespoke insurance solutions to clients in the U.K., Continental Europe, Israel, Australia, AsiaPacific, Canada and Latin America.

Gross premiums written in 2023 were $448 million compared to $470 million in 2022, a decrease of 5%, primarily due to our disciplined response to deteriorating market conditions in certain classes of business. Underwriting performance remained strong as Newline produced a net combined ratio of 91.3%, compared to 88.5% in 2022. This marked the 11th consecutive year that Newline achieved an underwriting profit.

The market is becoming more challenging, but Newline is well-positioned to take advantage of opportunities for growth in 2024. We have invested significantly in underwriting talent and plan to increase our geographical footprint, enabling us to service existing and potential clients and business partners on a local level.

$448.1M

2023 Gross Premiums Written

91.3%

2023 Combined Ratio