Odyssey Group is a globally diversified underwriter of property, casualty and specialty (re)insurance. Reinsurance is available around the world through OdysseyRe, while insurance is offered by Hudson Insurance Group in the U.S. and by Newline Group internationally.

We write business in more than 130 countries through a network of over 30 offices. Gross premiums written were $6.6 billion in 2023 compared to $6.8 billion in 2022.

Profitably managing Odyssey’s diverse and global portfolio requires our employees to thoroughly understand the local markets in which they operate and deliver high-quality, tailored service to our clients and business partners. In recent years, the (re)insurance markets have been plagued by abnormal weather events and other natural disasters, and increased competition that often results in inadequate pricing for the risks supported. By recognizing and appreciating the dynamics of local markets and maintaining our core principles of underwriting discipline and patience, our employees have enabled us to grow profitably and responsibly in many markets while continuing to provide the financial security and stability that our clients desire.

Odyssey Group’s 37 discrete business units are organized along different product, territorial and distribution lines, with 20 focused on reinsurance and 17 dedicated to insurance markets. This diversification provides the opportunity for expanding profitability and stabilizing our results. While underwriting discipline allows us to only take on risks that we believe can provide a fair return, diversification helps us mitigate volatility overall, including the vagaries of weather. As a global player diversified not only by region but also by product line, challenges or difficulties in one region of the world or in one product line are generally counterbalanced by opportunities or advantages in another.

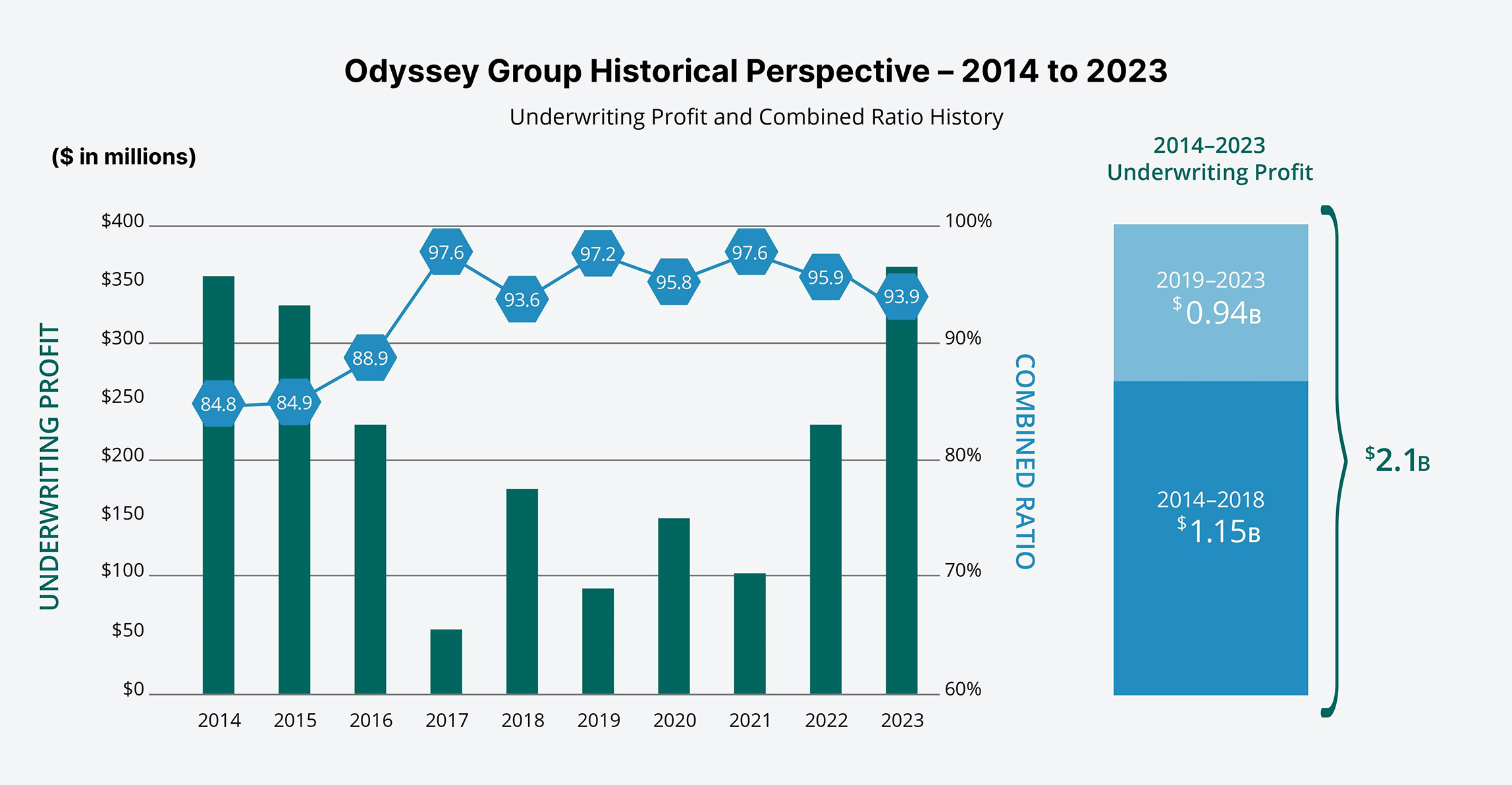

Our track record speaks for itself: 12 consecutive years of underwriting profits are in large part a testament to our diversification strategy.

Odyssey Reinsurance Company, our flagship carrier, operates through a global network of 13 branch, representative and service offices across five regions: North America, Latin America, Europe, Middle East & Africa (EMEA), AsiaPacific and London. In 2023, gross premiums written were $3.7 billion, on par with the prior year, with growth coming from all regions except North America, where the non-renewal of several large property quota share treaties was partially offset by diversified growth across all lines. Our reinsurance portfolio has produced an underwriting profit in 11 of the last 12 years, generating a combined ratio of 89.5% in 2023 compared to 95.5% in 2022. While high Cat activity over the last seven years drove hardening market conditions across most product lines, our focus continues to be on serving our clients by providing consistent and stable capacity. Click here for an overview of our reinsurance results by region.

Principally operating as commercial lines underwriters in the U.S. through Hudson Insurance Group and internationally through Newline Group, our insurance gross premiums written were $2.8 billion in 2023, a decrease of 8% over the prior year. For the 10th consecutive year, our insurance operations generated an underwriting profit, with the net combined ratio coming in at 97.1%, 4.2 points higher than the prior year.

Decreases in our insurance lines were driven at Hudson by repositioning the Crop portfolio to focus on more profitable commodities regions, and softened market conditions in other lines, particularly Management Liability, and at Newline by our disciplined response to deteriorating market conditions in certain classes of business. Click here for an overview of our insurance results.

With a portfolio heavily weighted to reinsurance, property accounted for 29% of gross premiums written ($1.9 billion) in both 2023 and 2022.

Cat losses during 2023, which included the earthquake in Turkey, hailstorms in Italy and the Lahaina wildfire on Maui, impacted the combined ratio by 7.2 points, versus 7.5 points in 2022. Catastrophe business represented 29% of our property book, compared to 22% in 2022, as rate adequacy improved in the hardening market. We continued to grow our property book by focusing on significant opportunities for proportional business with limited Cat exposure and appropriately priced Cat business. An area of continued concern is the adequacy of pricing for secondary perils.

Our diverse Casualty book of business, which represents 35% of our gross premiums written in both 2023 and 2022, decreased 4% to $2.3 billion. The insurance business written through Hudson and Newline currently represents 63% of Odyssey Group’s global casualty portfolio. The pricing momentum achieved in previous years in Directors & Officers Liability and Excess and Umbrella Liability business has receded somewhat in the past few years and we have adjusted our appetite for this business in response. For much of the last decade, our growth in casualty has relied heavily on insurance, as it gave us greater control over pricing, risk selection and claims handling. As the benefits of the improving insurance market have flowed into reinsurance over the last few years, so has our interest in expanding OdysseyRe’s casualty portfolio, especially for business emanating from the U.S. and London. While improving over the last few years, commission rates on quota share business remain stubbornly high, requiring us to be more selective as we consider opportunities for additional growth in reinsurance.

Odyssey Group’s specialty lines portfolio encompasses Crop and Livestock, Surety, Credit, Marine, Aerospace, Motor, Accident & Health, Affinity & Special Risks, Cyber Liability, Energy and Multiline, with Hudson and Newline representing 56% of Odyssey Group’s global specialty portfolio. The specialty portfolio decreased by 4% in 2023, to $2.4 billion, representing 36% of gross premiums written in both 2023 and 2022. Repositioning the Hudson Crop portfolio to focus on more profitable commodities regions and client restructuring of reinsurance programs in Accident & Health are the main drivers behind the overall decrease in Specialty.

As the pricing environment in many specialty lines tends to be more localized, our growth is more targeted, allowing us to use our global reach to take advantage of opportunities as they have arisen. Specialty lines remain an important focus for us as they offer a diversified stream of earnings that are generally less volatile and capital-intensive, making further expansion attractive.

Odyssey Group reported a net combined ratio of 93.9% for 2023, an improvement of 2.0 points over the prior year. We produced an underwriting profit for the 12th consecutive year, driven by improved market conditions, especially in reinsurance, favorable prior year development and disciplined underwriting in softer markets, despite above average Cat activity. Property Cat losses for 2023 were $68 million higher than expectations, increasing the combined ratio by 1.1 points, compared to 2022 when property Cat losses were $136 million higher than expectations, increasing the combined ratio by 2.4 points.

Reserve releases in 2023 were $79 million, reducing the combined ratio by 1.3 points compared to 1.0 point the previous year. Favorable prior year reserve development was recorded in most business units, although adverse development continues to emanate from some U.S. casualty lines; Group-wide reserve development contributed positively to our underwriting bottom line for the 16th straight year.