Odyssey Group is a globally diversified underwriter of property, casualty and specialty (re)insurance. Reinsurance is available around the world through OdysseyRe, while insurance is offered by Hudson Insurance Group in the U.S. and by Newline Group internationally.

We write business in more than 130 countries through a network of over 30 offices located in 13 countries. Gross premiums written were $6.8 billion in 2022 compared to $5.7 billion in 2021.

Higher than average Cat activity in recent years, including modelled and un/under modelled events, have presented challenges to many in the (re)insurance industry. By staying true to our core principles of diversification, discipline and patience, Odyssey Group continued to grow the Company in a measured way, never compromising our commitment to provide financial security and stability to our clients. Our employees continue to seamlessly deliver the high-quality service our clients and business partners have come to expect.

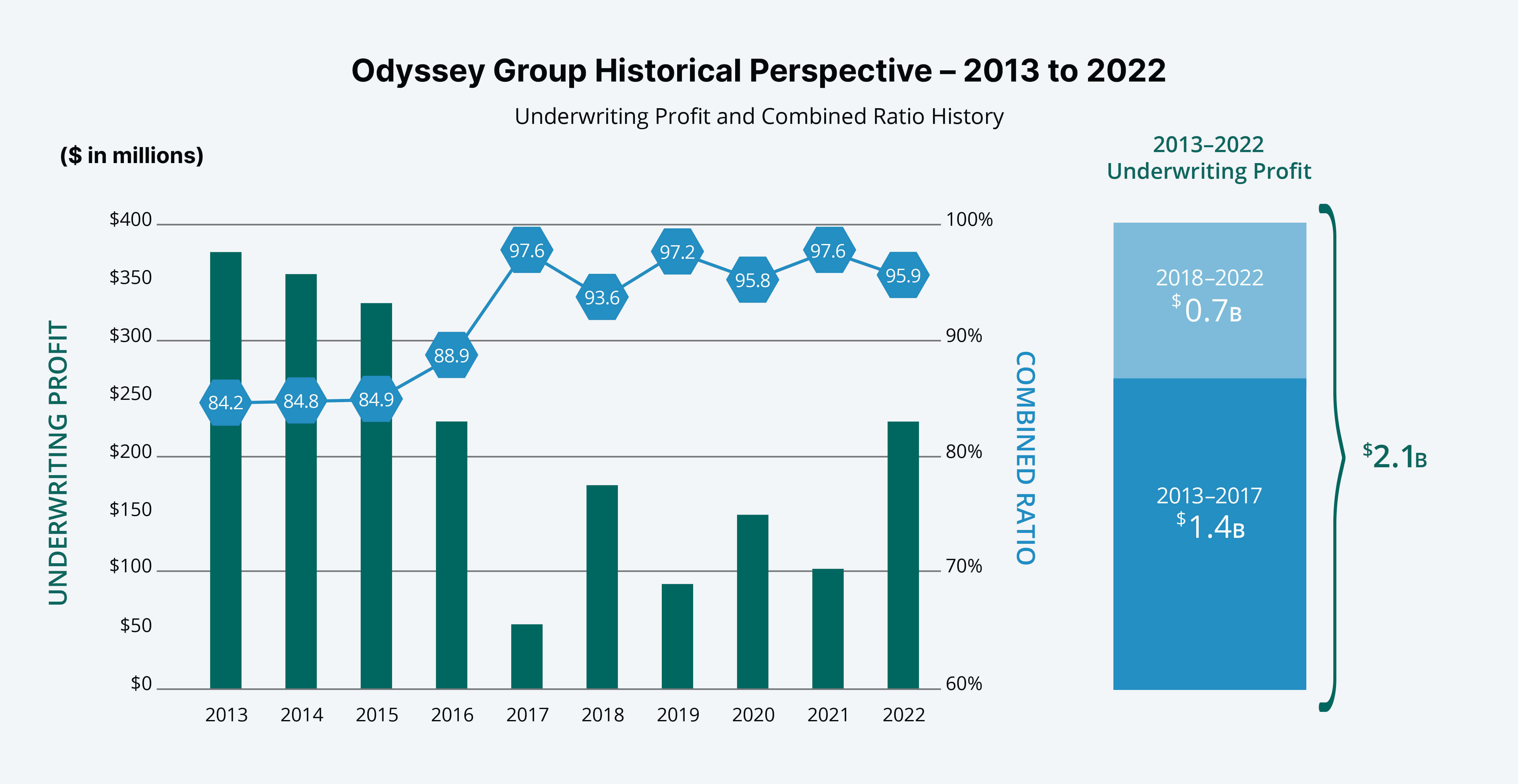

Diversification is critical to our business strategy as it enhances portfolio stability. Challenges or difficulties in one region of the world or in one of our product lines is usually counteracted by opportunities or favorable conditions in another. Our track record speaks for itself: 11 consecutive years of underwriting profits is in large part a testament to our diversification strategy. In addition, our global network and varied underwriting platforms enable us to respond rapidly to business opportunities as they emerge around the world. We have 37 discrete business units organized along different product, territorial and distribution lines, with 20 of these focused on reinsurance and 17 dedicated to insurance markets.

Odyssey Reinsurance Company, our flagship carrier, operates through a global network of 14 branches and representative offices across five regions: North America, Latin America, Europe, Middle East & Africa (EMEA), AsiaPacific and London. In 2022, gross premiums written were $3.7 billion, an increase of 31% over the prior year, with diversified growth coming mostly from North America, Latin America and London. Our reinsurance portfolio has produced an underwriting profit in 10 of the last 11 years, generating a combined ratio of 95.5% in 2022 compared to 100.0% in 2021. While high Cat activity over the last six years is driving hardening market conditions across most product lines, our focus continues to be on serving our clients by providing consistent and stable capacity. Click here for an overview of our reinsurance results by region.

Principally operating as commercial lines underwriters in the U.S. through Hudson Insurance Group and internationally through Newline Group, our insurance gross premiums written were $3.1 billion in 2022, an increase of 6% over the prior year. For the ninth straight year, our insurance operations generated an underwriting profit, with the net combined ratio coming in at 92.9%, 2.0 points higher than the prior year.

Growth in our insurance lines was driven by the continued positive rate environment in many markets, as well as our ability to act quickly to opportunities arising through our network of business partners. Click here for an overview of our insurance results.

The Property portfolio is heavily geared to reinsurance where margins have historically been better, and we have tighter control over our tail risk. Property premium increased 30% in 2022 to $1.9 billion, driven by higher rates and improving margins in a hardening market. Property, as a percentage of the overall portfolio, increased from 26% to 29%, as growth in Property outpaced other classes.

Catastrophe business represented 22% of our Property book and 6% of our global gross premiums written, compared to 24% and 6% respectively in 2021.

We have seen meaningful improvement in property (re)insurance rates, terms and conditions the last two years, and we expect this to continue throughout 2023, if not beyond. The market needs to continue to develop and reflect appropriate risk-responsive pricing that addresses un/under-modeled losses before we will see significant expansion in our appetite for Cat exposure.

Our diverse Casualty book of business, which represents 35% of our gross premiums written in 2022 compared to 36% in 2021, grew 15% to $2.4 billion. The insurance business written through Hudson and Newline currently represents 64% of Odyssey Group’s global casualty portfolio. The pricing momentum achieved in previous years in Directors & Officers Liability and Excess and Umbrella Liability business made these lines attractive, but that momentum is moderating. For much of the last decade, our growth in casualty has relied heavily on insurance, as it gave us greater control over pricing, risk selection and claims handling. As the benefits of the improving insurance market have flowed into reinsurance over the last few years, so has our interest in expanding OdysseyRe’s casualty portfolio, especially for business emanating from the U.S. and London. While improving over the last few years, commission rates on quota share business remain stubbornly high, requiring us to be more selective as we consider opportunities for additional growth in reinsurance.

Odyssey Group’s specialty lines portfolio encompasses Crop, Livestock, Surety, Credit, Marine, Aerospace, Motor, Accident & Health, Affinity & Special Risks, Cyber Liability, Energy and Multiline, with Hudson and Newline representing 60% of Odyssey Group’s global specialty portfolio. The specialty portfolio grew by 14% in 2022, to $2.5 billion, representing 36% of gross premiums written in 2022 compared to 38% in 2021. Expansion of our Crop insurance, Accident & Health and Cyber reinsurance businesses are the main driver behind overall growth in Specialty, helping to provide further diversification benefits.

As the pricing environment in many specialty lines tends to be more localized, our growth is more targeted, allowing us to use our global reach to take advantage of opportunities as they have arisen. Specialty lines remain an important focus for us as they offer a diversified stream of earnings that are generally less volatile and capital-intensive, making further expansion attractive.

Odyssey Group reported a net combined ratio of 95.9% for 2022, an improvement of 1.7 points over the prior year. We produced an underwriting profit for the 11th consecutive year, driven by improved market conditions, especially in reinsurance, and favorable prior year development, despite above average Cat activity. Property Cat losses for 2022 were $136 million higher than expectations, increasing the combined ratio by 2.4 points, compared to 2021 when property Cat losses were $185 million higher than expectations, increasing the combined ratio by 4.4 points.

Reserve releases in 2022 were $55 million, reducing the combined ratio by 1.0 point compared to 2.8 points the previous year. Favorable prior year reserve development was recorded in almost business units, although adverse development continues to emanate from some U.S. casualty lines; Group-wide reserve development contributed positively to our underwriting bottom line for the 15th straight year.