The momentum behind our insurance portfolio continues to build and we have experienced healthy growth for the sixth year in a row. In 2022, gross premiums written generated by our insurance operations were $3.1 billion, an increase of 6% over the prior year.

For the ninth consecutive year, our insurance operations generated an underwriting profit, with the net combined ratio coming in at 92.9%, an increase of 2 points from 2021. Growth in our insurance lines was driven by the continued positive, though moderating a bit, rate environment in many markets, as well as our ability to act quickly to opportunities arising through our network of business partners.

In the U.S., insurance is underwritten by Hudson Insurance Group. With headquarters in New York and offices across the U.S. and in Vancouver, Canada, Hudson offers primary and excess insurance on an admitted and non-admitted basis.

Outside the U.S., Newline Group offers insurance products in more than 80 countries around the world. It is headquartered in London and operates through three underwriting platforms: Newline Syndicate 1218 at Lloyd’s, Newline Insurance Company Limited and Newline Europe Versicherung AG (Newline Europe).

2022

GROSS PREMIUMS WRITTEN

$2.6

Billion

2022

COMBINED RATIO

$93.8%

2022

GROSS PREMIUMS WRITTEN

$2.6

Billion

2022

COMBINED RATIO

93.8%

Christopher L. Gallagher

Chief Executive Officer

Hudson Insurance Group

Widely known for serving market niches that require highly specialized claims and underwriting capabilities, Hudson offers a wide range of property, casualty and specialty insurance products to corporations, professional firms, and individuals through retailers, wholesalers and program administrators.

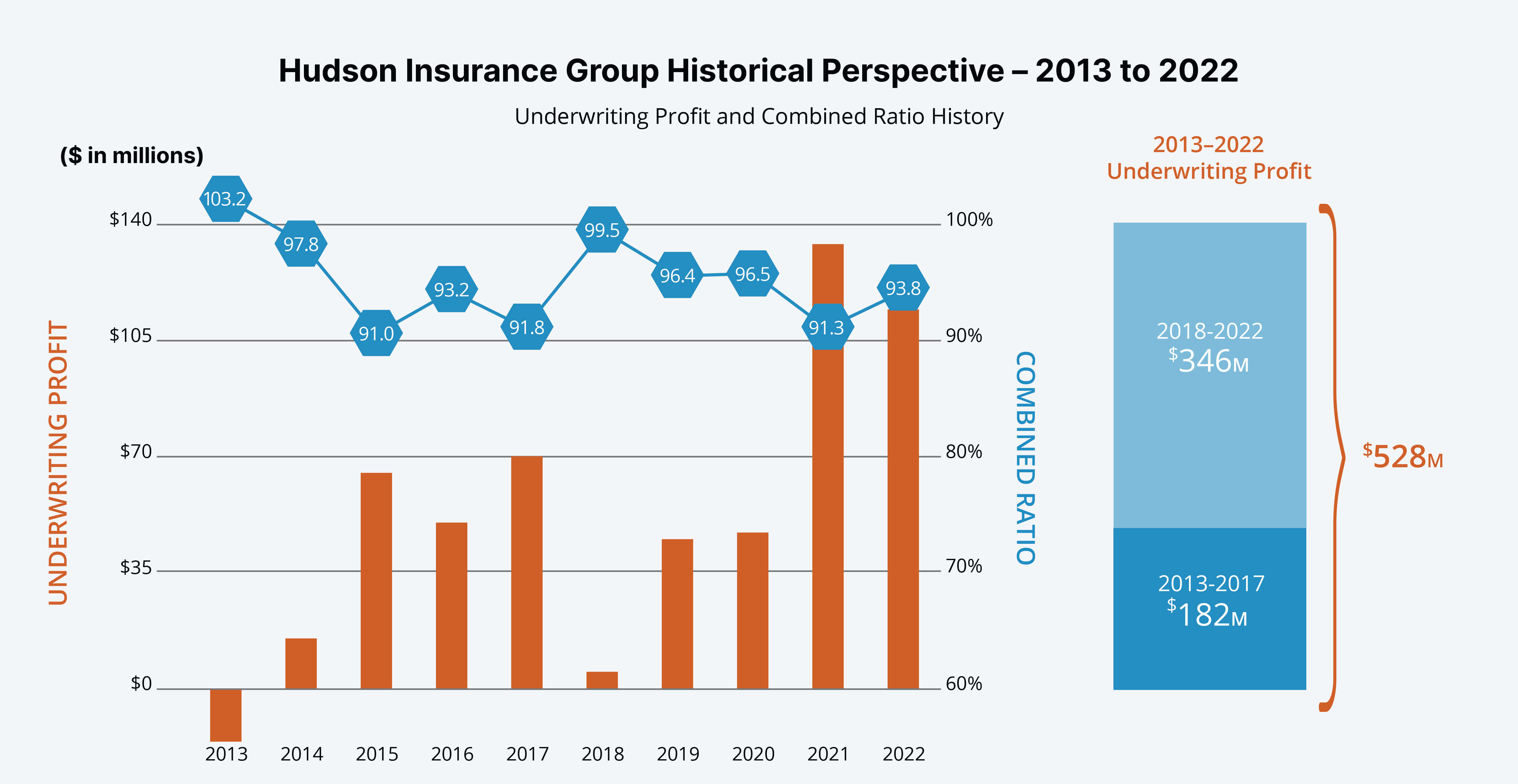

Hudson’s growth continued in 2022, with gross premiums written of $2.6 billion compared to $2.4 billion in 2021, an increase of 9%. Growth was most notable within Crop & Livestock, General Liability & Umbrella, Commercial Auto, Specialty Multiline and Surety business lines. Current market conditions remain promising as rates have stabilized at attractive levels.

For the ninth consecutive year, Hudson reported an underwriting profit, ending 2022 with a net combined ratio of 93.8% compared to 91.3% in 2021. This result was driven by our relentless dedication to underwriting diligence while providing excellent claims handling service.

Hudson continued to expand its professional lines’ product offerings, which are marketed under the banner of HudsonPro®. New products launched in 2022 include General Partners’ Liability, Cannabis Management Liability and Large Account Excess Cyber. Its Ancillary Medical Malpractice Liability unit also established a new facility to serve the unique needs of small healthcare businesses.

2022

GROSS PREMIUMS WRITTEN

$2.6

Billion

2022

COMBINED RATIO

93.8%

2022

GROSS PREMIUMS WRITTEN

$2.6

Billion

2022

COMBINED RATIO

93.8%

2022

GROSS PREMIUMS WRITTEN

$470

Million

2022

COMBINED RATIO

88.5%

2022

GROSS PREMIUMS WRITTEN

$470

Million

2022

COMBINED RATIO

88.5%

Robert Pollock

Chief Executive Officer

Newline Group

Newline provides an array of insurance solutions to clients in the U.K., Continental Europe, Israel, Australia, AsiaPacific, Canada and Latin America.

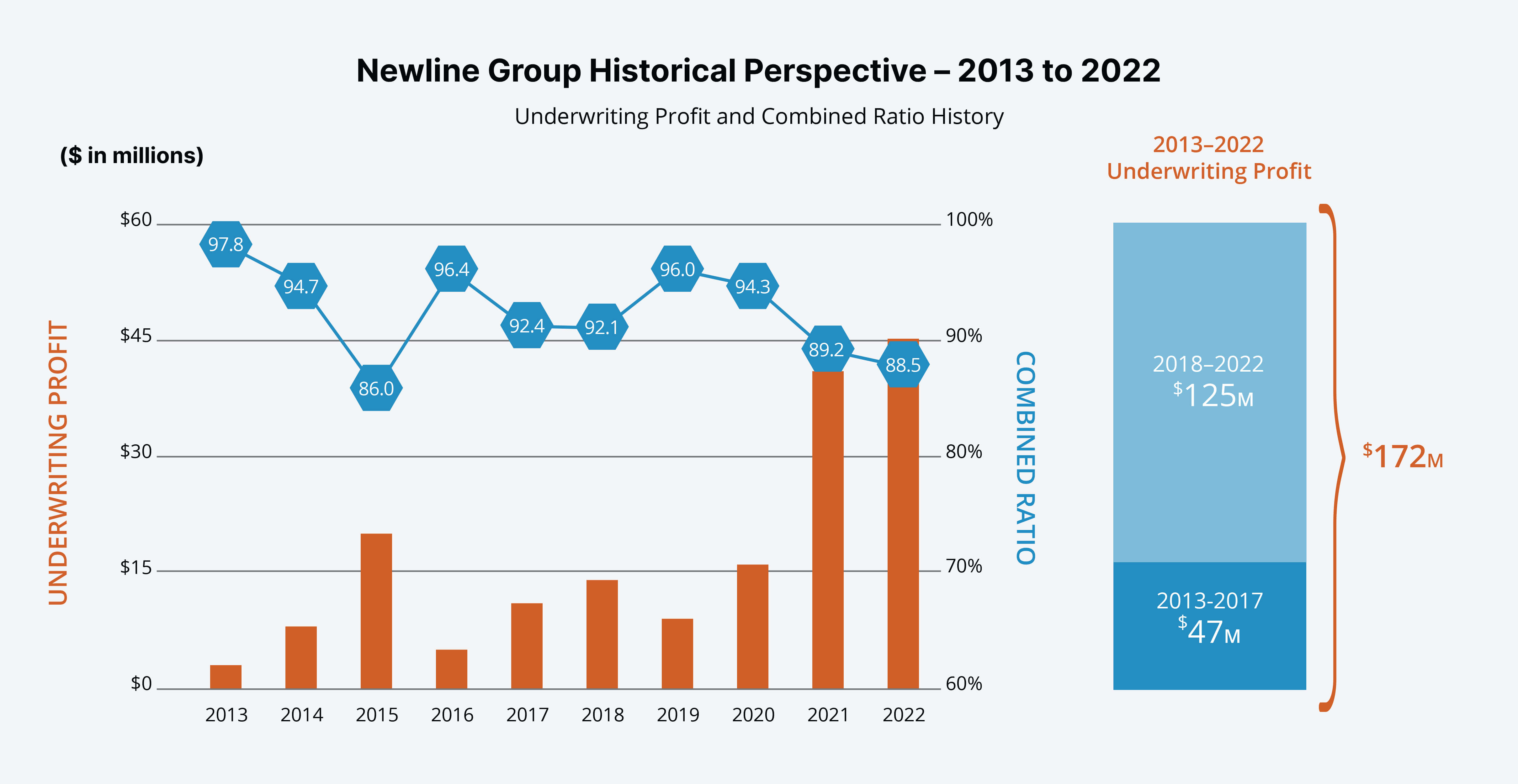

Gross premiums written in 2022 were $470 million compared to $491 million in 2021, a decrease of 4%, driven by a stronger U.S. dollar. Underwriting performance continued to be impressive, with a net combined ratio of 88.5%, compared to 89.2% in 2021. 2022 was a landmark year with Newline achieving 10 consecutive years of underwriting profit.

In 2022 we also celebrated the fifth anniversary of our presence in Germany, which began as a branch office of Newline Insurance Company Limited in 2017 to give the German speaking market direct access to Newline Group’s specialized products and capabilities. This was followed by the establishment of Newline Europe Versicherung A.G. in March 2019 to serve as the Group’s European Union insurance hub. What started out as a small branch office has in five short years generated over $150 million gross premiums written.

We continue to find the market attractive across all of our lines of business, given the historic rate increases and improvements in terms and conditions. In 2023, we anticipate growth in Commercial Professional Indemnity, Cargo and Affinity & Special Risk driven by recent investments in underwriting expertise.

Newline Syndicate at Lloyd’s

Newline Insurance Company Limited