The momentum behind our insurance portfolio continues to build and we have experienced substantial, healthy growth for the fifth year in a row. In 2021, gross premiums written generated by our insurance operations were $2.9 billion, an increase of 30% over the prior year.

For the eighth consecutive year, our insurance operations generated an underwriting profit, with the net combined ratio coming in at 90.9%, an improvement of 5.2 points from 2020. Growth in our insurance lines was driven by the continued positive rate environment in many markets, as well as our ability to act quickly on opportunities arising through our network of business partners. Our business pipeline is strong and the rating environment, though moderating a bit, remains positive, so we remain bullish about our future growth prospects.

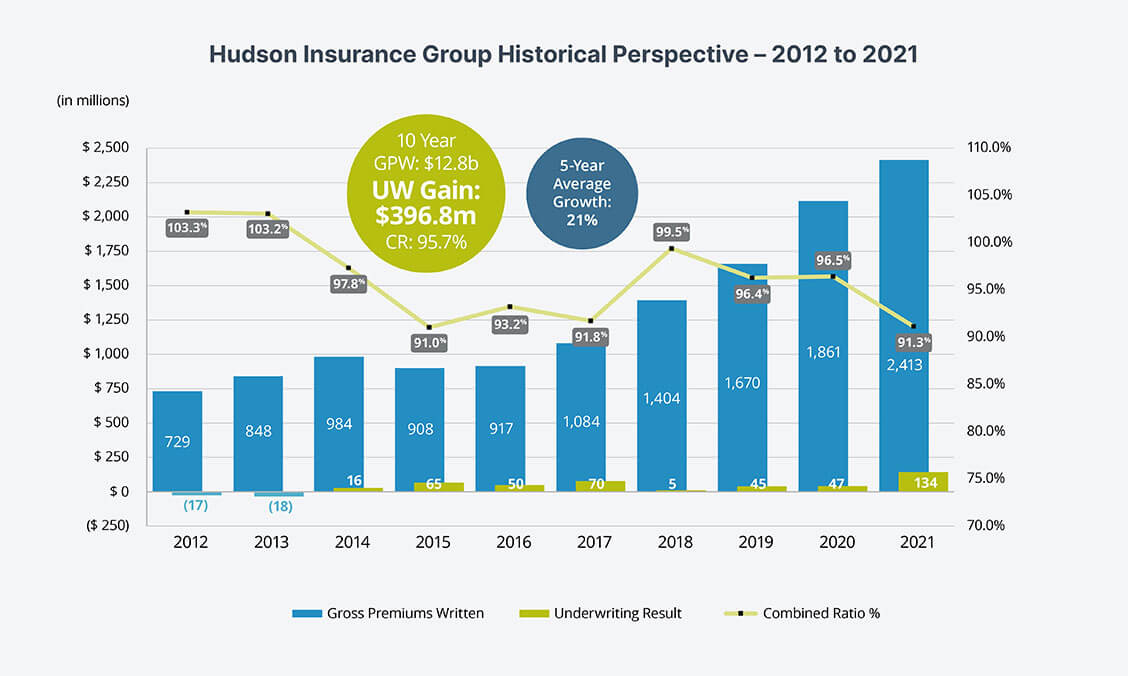

In the U.S., insurance is underwritten by Hudson Insurance Group. With headquarters in New York and offices across the U.S. and in Vancouver, Canada, Hudson offers primary and excess insurance on an admitted and non-admitted basis.

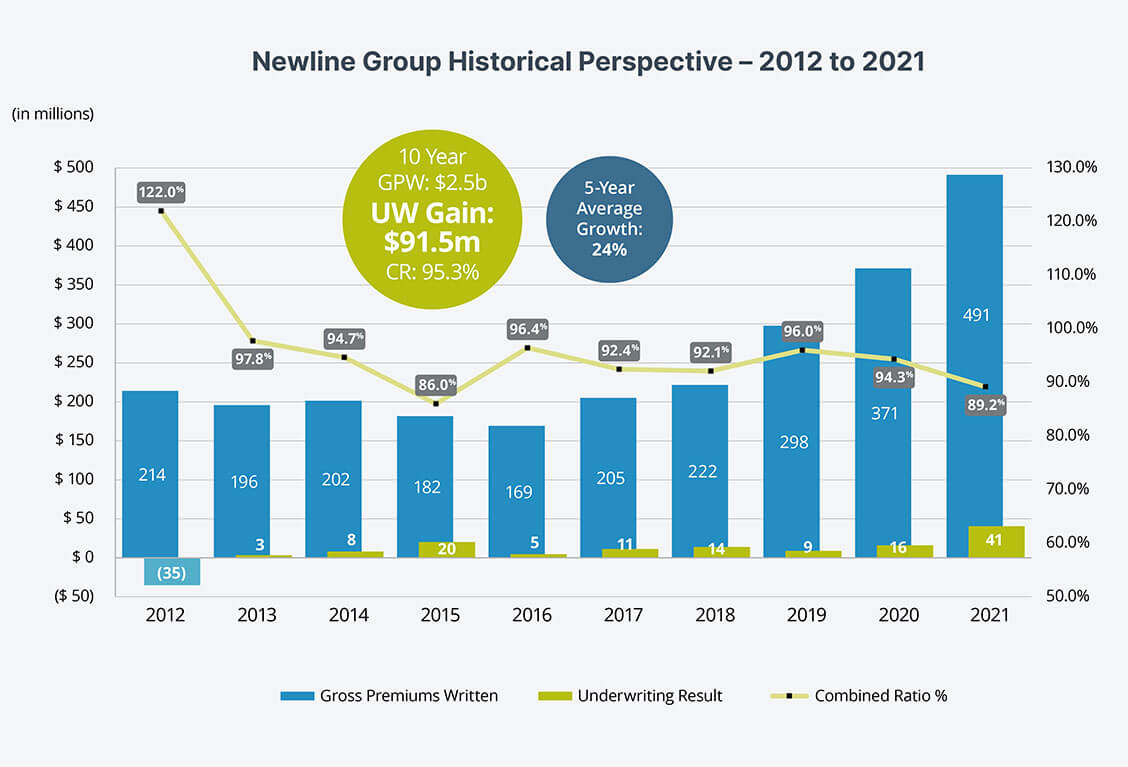

Outside the U.S., Newline Group offers insurance products in more than 80 countries around the world. It is headquartered in London and operates through three underwriting platforms: Newline Syndicate 1218 at Lloyd’s, Newline Insurance Company Limited and Newline Europe Versicherung AG (Newline Europe).

Christopher L. Gallagher

Chief Executive Officer

Hudson Insurance Group

Widely known for serving market niches that require highly specialized claims and underwriting capabilities, Hudson offers a wide range of property, casualty and specialty insurance products to corporations, professional firms, and individuals through retailers, wholesalers and program administrators.

Hudson’s growth continued in 2021, with gross premiums written of $2.4 billion compared to $1.9 billion in 2020, an increase of 30%. Growth was most notable within Crop, Financial Products, Professional Liability and General Liability & Package business lines. Current market conditions remain promising as rates continue to firm, albeit at a more moderate pace.

For the eighth consecutive year, Hudson reported an underwriting profit, ending 2021 with a net combined ratio of 91.3% compared to 96.5% in 2020. This result was driven by firming rates in our Financial Products and other Casualty lines, as well as favorable market conditions in our Crop business.

We began 2021 by increasing our professional lines’ bench strength with the team from Validus Specialty Underwriting Services. This enabled us to launch a Financial Institutions Liability product and ultimately rebrand our professional lines suite of products under the umbrella of HudsonPro®. As more opportunities emerge in this sector, we will continue to expand our professional lines offerings to capitalize on those that suit our appetite.

In line with this strategy and in response to an attractive opportunity, we established a new Inland Marine business in September that is focused on transportation cargo, and we anticipate expanding into similar products in due course.

2021 GROSS PREMIUMS WRITTEN

$2.4

Billion

2021 COMBINED RATIO

91.3%

Carl A. Overy

Chief Executive Officer

Newline Group

Newline provides an array of insurance solutions to clients in the U.K., Continental Europe, Australia, AsiaPacific, Canada and Latin America.

Newline marked its 25th anniversary year with stellar results in 2021. Gross premiums written were $491.2 million compared to $371.3 million in 2020, an increase of 32%. Underwriting performance was also impressive, improving to a net combined ratio of 89.2%, compared to 94.3% in 2020. Growth in 2021 was evident across all lines of business, but principally driven by Liability, Directors & Officers Liability and Affinity & Special Risks.

Improved market conditions and increasing demand for our products has fueled Newline’s growth in recent years. One of the most notable areas is Clinical Trials, as our underwriting team continues to see significant submission activity. By the end of 2021, Newline was insuring over 700 clinical trials associated with COVID-19. These trials related to diagnostics and therapeutics, as well as a number of actual vaccine trials. Newline also provided product liability solutions to various vaccine designers, manufacturers and distributors to help facilitate access to the vaccines across the globe.

As the casualty market has seen rate increases and improved terms and conditions for several years now, Newline is well-positioned to take advantage of the opportunities for growth in 2022 and beyond.

2021 GROSS PREMIUMS WRITTEN

$491.2

Million

2021 COMBINED RATIO

89.2%

Newline Syndicate at Lloyd’s

Newline Insurance Company Limited