Odyssey Group is a globally diversified underwriter of property, casualty and specialty (re)insurance that operates through five Divisions: North America, Latin America, EuroAsia, London Market and U.S. Insurance. We write business in more than 100 territories through a network of over 30 offices located in 13 countries. Gross premiums written were $4.4 billion in 2020 compared to $3.8 billion in 2019.

There has never been a more challenging test of our operational efficiency and resilience than dealing with COVID-19. Our employees around the world adapted quickly to the changing work environment and, without pause, continued to seamlessly deliver the high-quality service our clients and business partners have come to expect.

Diversification is critically important to our business strategy, as it provides portfolio stability and greater flexibility to actively manage the (re)insurance cycle. With our global network, we are able to rapidly respond to business opportunities as they emerge around the world. We have 35 discrete business units organized along different product, territorial and distribution lines, with 19 of these focused on reinsurance and 16 dedicated to insurance markets.

Property accounted for 26% of gross premiums written in each of the last two years. Our portfolio remains heavily weighted to reinsurance, but our appetite for U.S. insurance risk underwritten through Hudson has increased following the meaningful market corrections the last few years.

Catastrophe business, representing 28% of our property book, saw reduced Cat losses in 2020 despite a substantial uptick in U.S. windstorm activity. We tend to shy away from frequency exposed layers and aggregate covers, which explains why our Cat experience in 2020 was more favorable than many of our peers.

While we have seen some narrowly focused, experience-driven improvement in reinsurance rates the last few years, a global price correction is long overdue and much needed to address un/under- modeled losses that have pestered our industry for too long.

Casualty represented 34% of our gross premiums written in 2020 compared to 31% in 2019. In dollar terms, the portfolio expanded 28% from $1.2 billion to $1.5 billion. Most areas of the casualty market have significantly improved over the last 24 months, nowhere more so than in Directors & Officers Liability and Excess and Umbrella Liability business. The insurance business written through Hudson and Newline currently represents 72% of Odyssey Group’s global casualty portfolio. The book of business is very diverse in terms of product mix and geographic scope. For much of the last decade, we placed more emphasis on writing insurance, not only because it gave us greater control over pricing, risk selection and claims handling, but we could also use reinsurance to reduce volatility. As the benefits of the improving insurance market have flowed into reinsurance over the last 24 months, so has our interest in expanding OdysseyRe’s casualty portfolio, especially for business emanating from the U.S., London and Bermuda. The one aspect of the reinsurance market that continues to frustrate us is that commission rates on quota share business remain stubbornly high in the low to mid-thirties. Until we see commission rates return to normal cycle averages, casualty insurance will remain a more attractive proposition for us.

Other specialty lines, including Crop, Surety, Credit, Marine, Aerospace, Motor, Accident & Health, Affinity & Special Risks, Cyber Liability, Energy and Multiline represented 40% of gross premiums written in 2020 compared to 43% in 2019. The insurance business written through Hudson and Newline currently represents 61% of Odyssey Group’s global specialty portfolio. Business volumes in Motor, Affinity & Special Risks, Surety and Credit were adversely impacted by COVID-19, but we remain bullish on these sectors and expect further growth once the global economy fully recovers. The pricing environment in many specialty lines tends to be more local and with our global reach we have been able to take advantage of opportunities as they have arisen. Specialty lines offer a diversified stream of earnings that are generally less volatile and capital-intensive, making further expansion attractive.

Our flagship carrier, Odyssey Reinsurance Company, operates through a branch and representative network of 14 offices located in 10 countries around the world. In 2020, we wrote $2.2 billion of gross premiums written, an increase of 20% over the prior year, with growth coming from nearly every region and most product lines. Our reinsurance results were excellent, despite a $138 million loss provision for COVID-19, most of which related to property business interruption claims in Europe and South Africa. For the 9th year running, our reinsurance portfolio produced an underwriting profit, generating a combined ratio of 92.4%, compared to 93.7% in 2019. The improvement in our underwriting margin year-on-year was mostly driven by lower catastrophe losses affecting our results in 2020.

We are principally a commercial lines underwriter, operating in the U.S. through Hudson Insurance Group and internationally through the Newline Group. Gross premiums written generated by our insurance operations were $2.2 billion in 2020, an increase of 13% over the prior year. For the 7th straight year, our insurance operations generated an underwriting profit, with the net combined ratio coming in at 96.1%, 0.2 points better than the prior year. Our insurance operations had minimal COVID-19 losses in 2020 and we are pleased to advise that we don’t have a single pandemic-related claim in dispute or litigation at this time. The insurance rating environment remains positive and our business pipeline is strong, so we remain bullish about our future growth prospects.

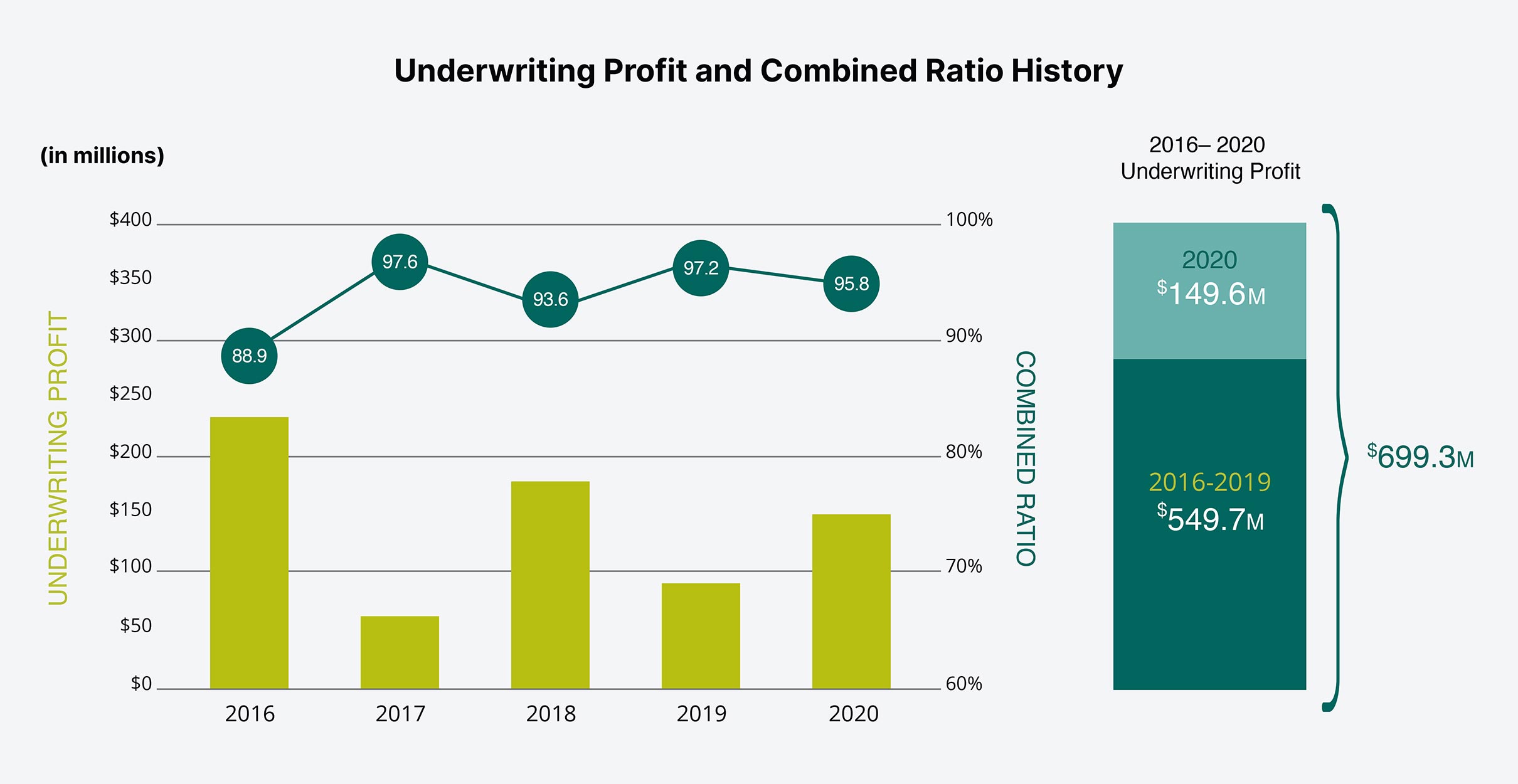

Odyssey Group reported a net combined ratio of 95.8% for 2020, an improvement of 1.4 points on the prior year. For the 9th consecutive year we produced an underwriting profit, driven by lower Cat losses and favorable prior year development, partially offset by $140 million of COVID-19 claims. Property Cat losses for 2020 were $54 million less than expectations, decreasing the combined ratio by 1.5 points, compared to 2019 when property Cat losses were $93 million greater than expectations, impacting the combined ratio by 3.0 points.

Reserve releases in 2020 were $223 million, reducing the combined ratio by 6.2 points compared to 7.6 points the previous year. Favorable prior year reserve development was recorded in all operating divisions and, Group-wide reserve development contributed positively to our underwriting bottom line for the 13th straight year. Decreases in non-Cat loss reserves represented 60% of the releases in 2020, compared to 65% in 2019.